This is the fresh, first edition of our 2024 Loopring Quarterly Updates. You can catch up on the previous quarter here; you can also receive these updates in your inbox every quarter by subscribing here.

The first quarter of 2024 was highlighted by the release of a major upgrade to our Loopring Smart Wallet — Account Abstraction. The first implementation of this upgrade is now live on Taiko’s testnet, while the mainnet launch of this new wallet is expected for Q2.

We also released the first beta version of our new flagship product, Loopring Portal, to the ecosystem — bringing a CEX-like trading environment direct to the security of your self-custodial wallet.

On the community side, we have seen the launch of another NFT marketplace on Loopring (LayerLoot), and even more happening in the gaming world with big expansion moves from LooperLands and the launch of the new FedoraVerse, built on Loopring.

Read on for many more details + highlights as well as a few things to look forward to in the Loopring ecosystem.

✧️️️✦️️️✧

Milestones

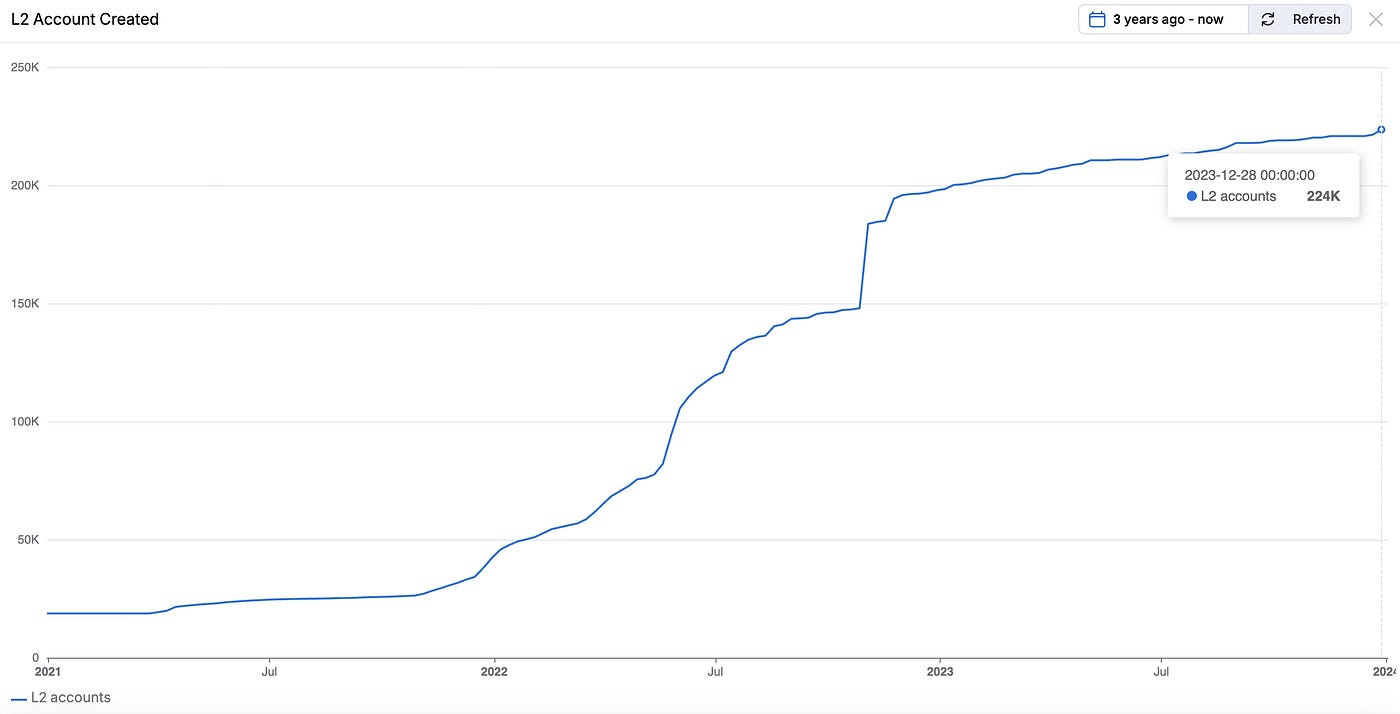

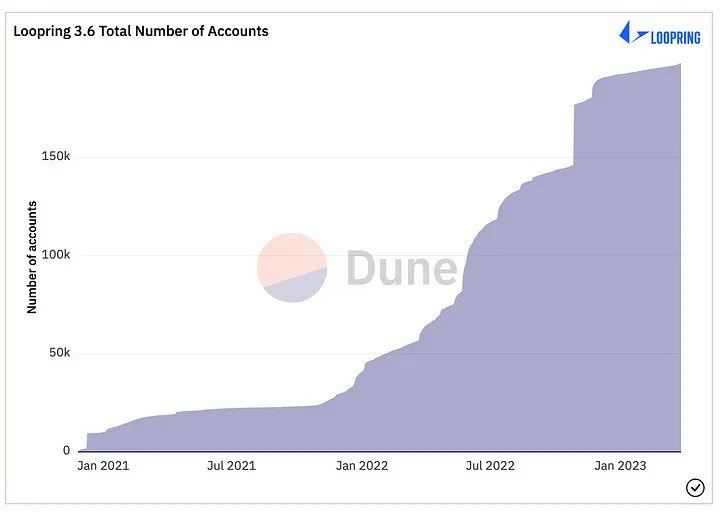

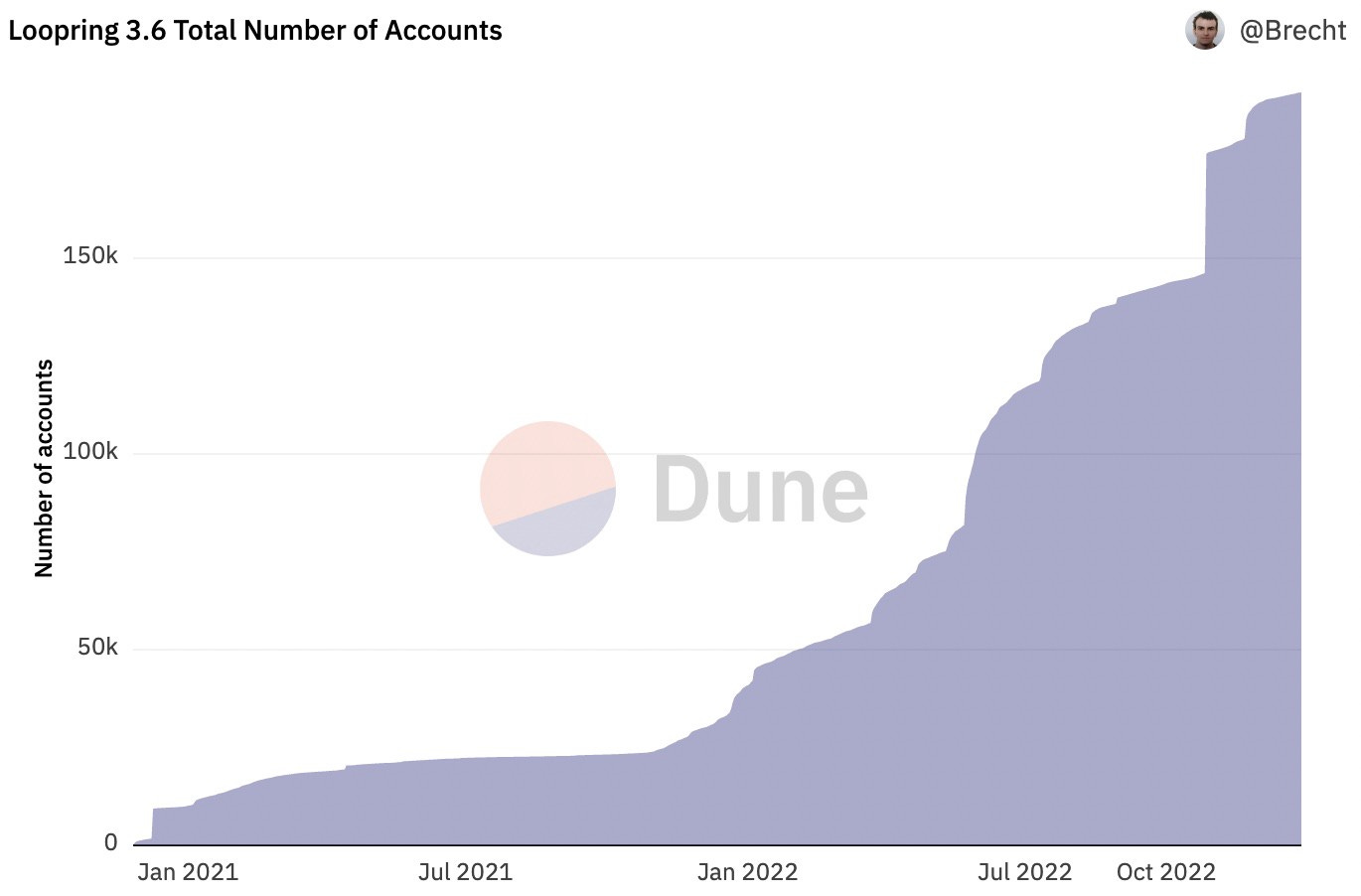

220K+ total L2 accounts and $130M+ of TVL on Loopring L2 at the close of Q1/2024 — showing steady growth over the past quarter

Multi-Network architecture in place — ready for deployment over 2024

Loopring Portal beta live — a new flagship product for the Loopring ecosystem is now live in beta on Loopring L2 and ready for multi-network deployment as well

Q1 Summary 🔹

A summary of our highlighted announcements and releases over the course of Q1/2024.

✧️️️✦️️️✧

1. Loopring Portal

The new Portal experience on Loopring L2 is finally here.

Loopring Portal is a new flagship product to the Loopring ecosystem, bringing a CEX-like trading environment direct to the security of your self-custodial wallet.

Imagine trading top token pairs, or hot new meme coins that aren’t available anywhere else on Ethereum, directly from your Loopring L2 self custody. Imagine getting the same CEX liquidity, as if you were trading top token pairs directly on a top CEX, but instead directly from your own wallet, without having to give up your assets to the custody of those CEXs. This is the new Loopring Portal.

Not only does the Portal open up many new token pairs (including tokens you can’t get anywhere else on Ethereum) to Loopring users, it also brings users the ability to trade these pairs with leverage — both long or short.

The Portal is set up like a separate account within your Loopring wallet. Similar to having a chequing or savings account within your bank. Use your regular spot account to access all of the Loopring Earn products (like staking, Dual Investment, etc.) or lock your assets as collateral in the Portal to open a position and explore a whole other world of CEX-like trading.

For a full technical blog and look inside the Loopring Portal feature, check out our latest blog here.

Loopring Portal is Live: A Look Inside

Introducing Loopring Portal

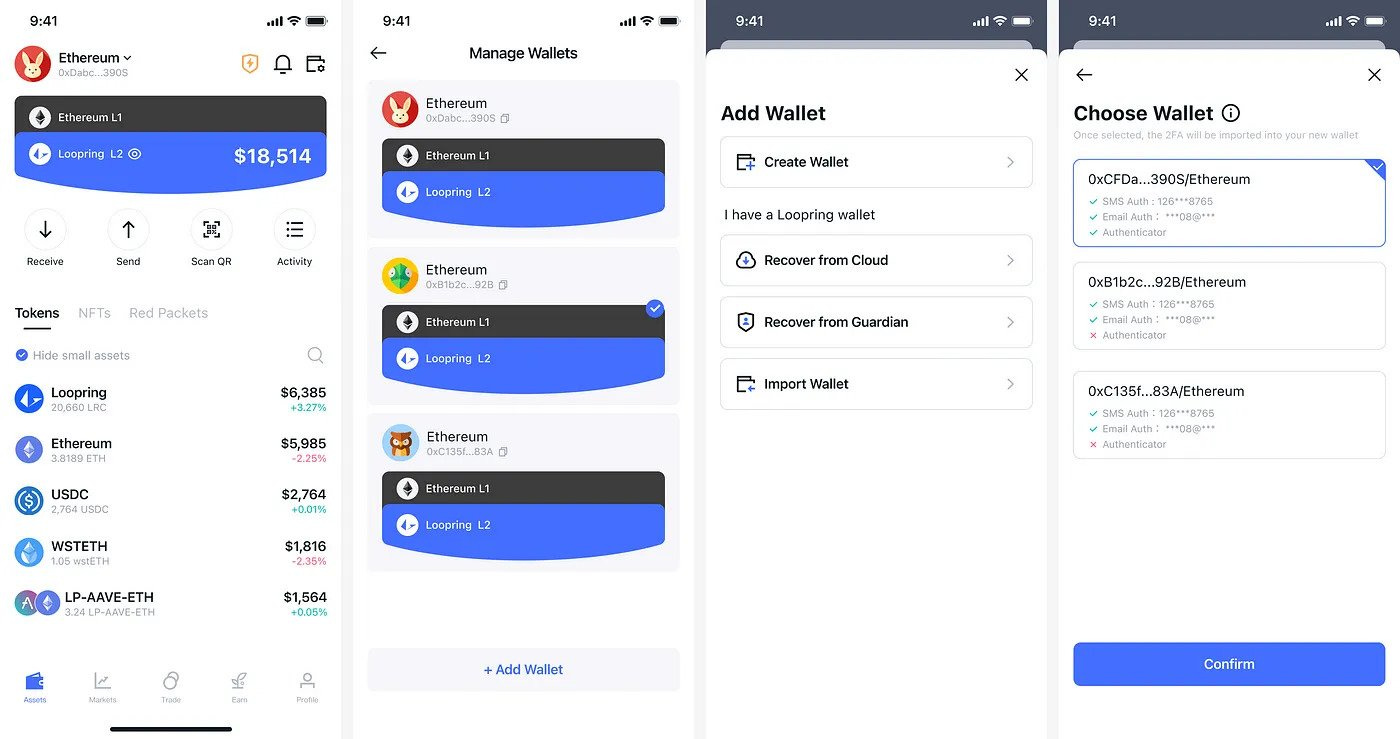

2. The new Account Abstraction wallet + Taiko A6

Come explore Account Abstraction on Taiko through the Loopring Smart Wallet for a chance to win a Loophead NFT!

We released a big, new upgrade to the Loopring Smart Wallet in Q1 — Account Abstraction.

Account Abstraction wallets have been acclaimed as the groundbreaking new wallet innovation that will help usher in the next billion users to the Web3 era with the seamless simplicity of a Web2 user experience. Our Loopring Account Abstraction wallet is now here and going live across Ethereum soon.

Loopring has been a pioneer on many fronts in the crypto space, and Account Abstraction is now another avenue where we are helping lead the space forward.

Want to learn more about what Account Abstraction means for the end user? Check out our tweet thread here:

BLOG: Pioneering Account Abstraction on Ethereum: Loopring’s new Account Abstraction Wallet

Once you’ve set up your new Taiko wallet, you can bind a Loopring L2 address for your chance to win a Loophead NFT as part of our 2024 Loophead Challenge (more in the Path Forward section below).

3. Community Call #2: Full Recap

This past quarter we continued our community calls to provide a way for the team to share information regarding current projects and upcoming features, as well as give the community the opportunity to ask questions and provide feedback.

You can check out the full recap blog here (which includes some expanded answers), or if you want to listen to the full call (with timestamps for your viewing pleasure), check out the full recording below ↓

Stay tuned to our socials for another upcoming Community Call this quarter to discuss all things Loopring 2024.

4. Loopring x MoonPay

MoonPay is our latest on-ramp/off-ramp integration in the Loopring Smart Wallet.

Moonpay is your gateway to Web3 with one of crypto’s most recognized and accessible on and off ramps. You can buy or sell crypto directly to <> from your bank <> wallet with options like Google Pay and Apple Pay.

With even more jurisdictions around the world covered, MoonPay should be your most convenient option for getting fiat in and out of your Loopring Wallet.

With our latest Loopring Smart Wallet update, you can now choose from 15 different Ethereum tokens when on-ramping fiat to your wallet — try it out today!

5. Loopring x WalletConnect

This past quarter, we were very excited to announce that we’ve integrated WalletConnect‘s web3modal into our Loopring Pro and Loopring Earn DApps.

This allows us to move away from custom connectors. By adopting the web3modal, we instantly get support for EIP-6963 as well as any new functionality that WalletConnect releases in the future!

What’s EIP-6963? It’s a new standard geared at improving the user experience between dApps and wallets. For Loopring Pro, this means that if you use wallet browser extensions, the WC modal will instantly pick them up and display them at the top for a quick and easy connection.

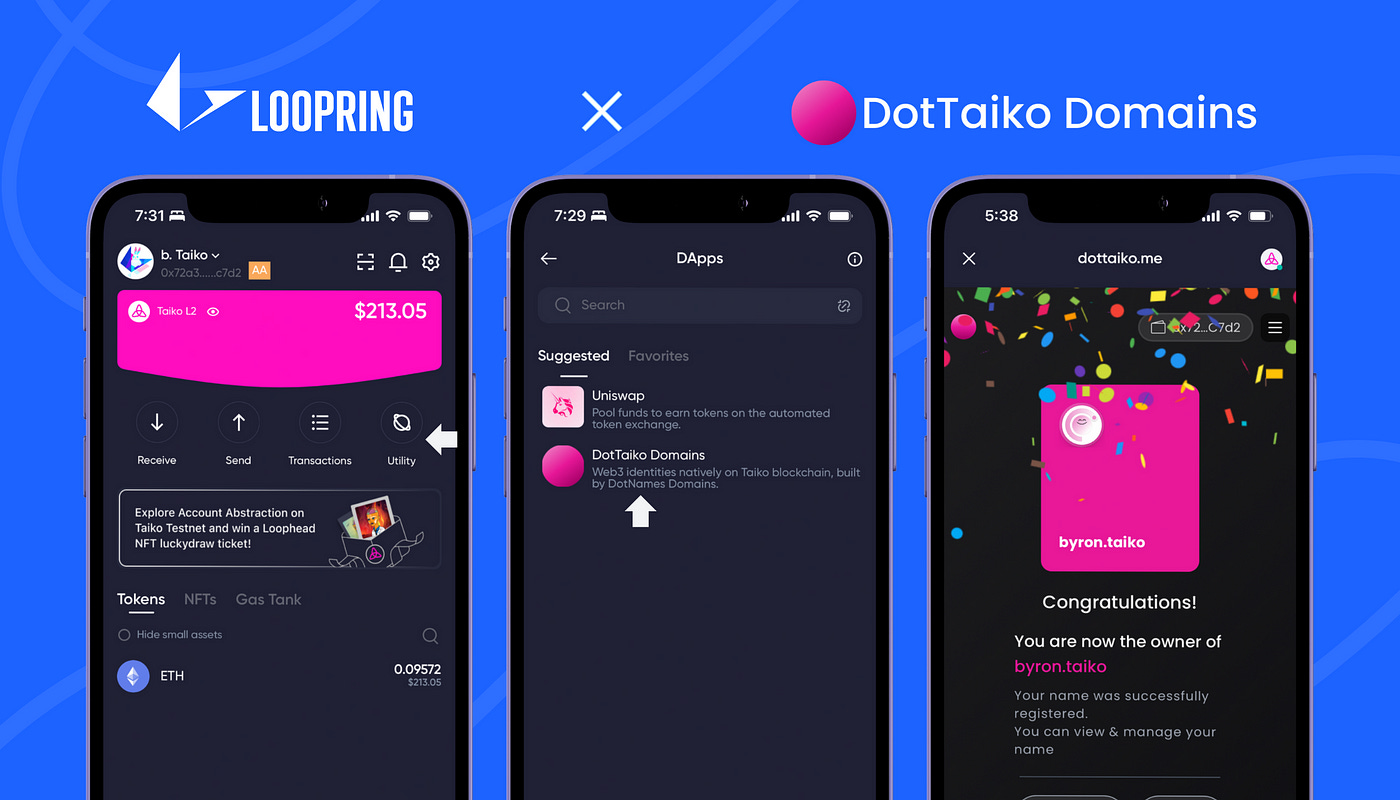

6. Loopring x DotTaikoNames

We’re collaborating with Taiko builders to bring the best user experience for Taiko, direct to the Loopring Smart Wallet — now with DotTaikoNames.

Have you picked up your DotTaiko identity for your Taiko wallet?

The Loopring Smart Wallet is your easiest way to interact with the Taiko testnets (and future Taiko mainnet). If you want to secure your own DotTaiko identity — simply follow the steps below:

🔹download the Loopring app

🔹set up a Taiko wallet

🔹auto-receive 0.1 test ETH

🔹grab your domain

For a quick video tutorial, check out our YouTube below ↓↓

Register your dot Taiko domain with the Loopring Smart Wallet for free today in under a minute!

TUTORIAL

7. Loopring now on GrowThePie.xyz

We’ve been pioneers in helping to grow the overall Ethereum pie since 2017 — so we’re very pleased to announce that we’re officially integrated with GrowThePie.xyz.

Get your live Loopring analytics and easily compare fundamental metrics across chains on their Loopring integrated web app here.

8. Loopring x Orbiter Finance

Orbiter now supports USDC transfers between Ethereum L1 <> Loopring L2

This new integration allows for fast, low-cost bridging of USDC between the two layers. From Ethereum L1 → Loopring L2 or in reverse from Loopring L2 → Ethereum L1, giving users even more options for bridging to and from Loopring.

The next step is to provide a seamless UX in our wallet when bridging ETH and USDC— giving Loopring Wallet users freedom of choice (trustless, fast withdrawals (coming soon!), Orbiter).

Try out even more bridging options with Orbiter today. Many more L2 <> L2 bridging options are already baked into the Loopring Smart Wallet experience!

9. Loopring L2 + Wallet Upgrades

We added a number of new upgrades + features throughout the Loopring L2 ecosystem this quarter. Check out some of the main highlights below👇

Loopring Portal Introduction:

Significant development and optimization efforts have been undertaken to introduce the Loopring Portal feature. This feature will enable users to trade tokens not available on the Loopring DEX by leveraging liquidity from centralized exchanges (CEX).

Account Abstraction:

Successfully launched the new smart wallet implementation with Account Abstraction on the Taiko A6 testnet.

Deployed Loopring paymaster and bundler services on Taiko A6 testnet.

Introduced Gas Tank support, allowing users to pre-deposit various tokens to the Gas Tank in advance, thereby saving on gas fees.

NFT Enhancements:

Implemented support for NFTs (ERC721 and ERC1155) on the Taiko platform.

Introduced the NFT burn feature, enabling users to send unwanted NFTs to a designated unused address.

Optimized NFT display by utilizing original thumbnail files instead of compressed cache files.

Other Optimizations:

Integrated MoonPay for seamless onramp/offramp functionality on Ethereum L1.

Extended IMX token support on Blocktrade.

Enhanced the internal Dapp Browser, now compliant with EIP6963 and capable of mimicking an injected Loopring browser extension when interacting with DApps.

Integrated all Loopring dapps with the latest web3Modal for an improved user connectivity experience.

Optimized Contact Usage: Loopring now alerts users in case of inconsistencies between saved ENS and wallet addresses to prevent mis-sending.

Enabled multiple red packets to be received by the same address for a single distribution, allowing users to participate in red packet campaigns with multiple tickets.

Achieved speed optimization for EddsaSignature, unlocks the usage like Grid Trade strategy on Loopring L2 which requires pre-signing hundreds of signatures in advance.

Implemented automatic wallet status calibration: In case of detecting potential abnormal wallet states, the application utilizes on-chain data to recalibrate the local state.

As always, we will continue to gather feedback from the community as well as work with our partners to add new features, tools, and improve the usability of Loopring L2 so that users can truly move closer to becoming their own bank.

Hottest features in your Loopring Smart Wallet🔥

In a new addition to the Loopring Quarterly updates, we’re going to highlight some of the most popular features that have been gaining attention and usage during the past quarter.

✧️️️✦️️️✧

Block Trade:

The best liquidity available on Ethereum, direct to your self custodial wallet, is now on Loopring L2.

In Q1, we expanded Block trade to now include Immutable X (IMX) as a swapable token.

You can now swap $ETH, $BTC, $USDC, $LRC and $IMX all with deep, centralized exchange (CEX) liquidity without having to give up your assets to the CEX.

Burn unwanted NFTs:

Got some NFTs in your wallet that you want to quickly dispose of?

You can now safely and easily burn any unwanted NFTs in your wallet with a click in your Loopring Smart Wallet with our new burn button.

Expanded Utility Tab on both Loopring L2 + Taiko wallets:

Make sure you keep an eye on the Utility tab in your Loopring Smart Wallet app in both your Loopring L2 and Taiko L2 wallets.

We’re always working to optimize and showcase as many DApps as possible to serve to Loopring users.

In Q1, we added LooperLands, the popular pixelverse game, into the Taiko utility tab and LayerLoot, the new NFT Marketplace, into the Loopring L2 utility tab.

Path Forward 🔹

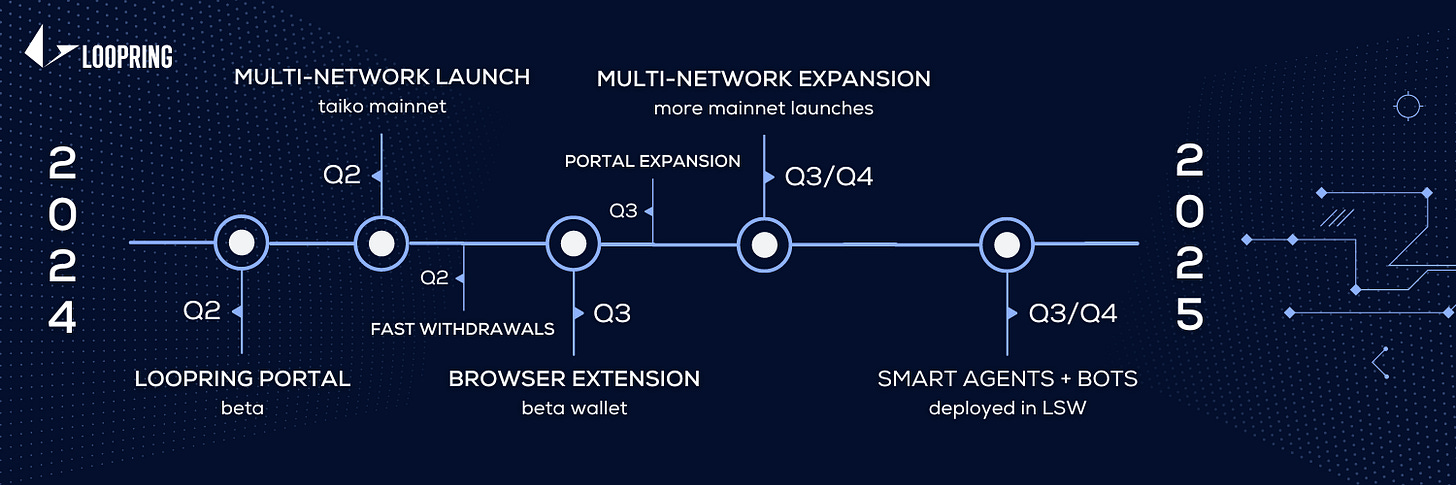

The following is an expected product development roadmap from the Loopring Foundation team. Please note that while all of these products + features are in development, timing cannot be guaranteed as priorities can shift over time based on internal or external circumstances.

✧️️️✦️️️✧

1. Loopring Portal Expansion

The new Portal experience has now arrived on Loopring L2 — with plans to expand the product Multi-Network with a many new token pairs coming also.

Loopring Portal is a new flagship product coming to the Loopring ecosystem, bringing a CEX-like trading environment direct to the security of your self-custodial wallet.

We believe this product has the potential to be a game-changer across Ethereum, offering a truly unique trading experience. We want to bring this experience to every user by rolling it out on Loopring L3 on top of every network across Ethereum.

Loopring Portal will also be expanding to many more token pairs, with the goal of serving up every hot or in-demand token across crypto (not just Ethereum-native tokens) to users straight to their self custodial wallets — on any network they already have their funds.

Demo Trading on Loopring

Another new feature that is going to be rolled out soon within the Portal is demo trading.

Not everyone is experienced enough in trading to be able to handle leverage or margin trading. This is why we will be introducing demo trading in the new Loopring Portal.

Anyone will be able to claim demo tokens (that have no value by nature — similar to testnet tokens), and use these tokens to test out trades with leverage.

Paper trade for fun, or test out strategies, and see how they play out before putting real money behind the trades — another way Loopring is helping new users onboard into crypto in a safe and secure way.

Stay tuned for more updates on this exciting development.

2. Multi-Network Loopring launching on Mainnet

Loopring is going to kick off its Multi-Network product launches on mainnet networks in Q2 2024.

Throughout 2024, a primary focus for us will be expanding Loopring beyond its current isolated L2 ecosystem, transforming it into a multi-network brand. Our goal is to offer some of the best user-facing products in crypto — available to any user, anywhere they are.

The first mainnet product launches you can look forward to will be on Taiko L2, after their mainnet launch, as well as on Base L2. After these deployments have been properly battle tested, you can expect many more networks to be activated over the following months.

You can read up more on our Multi-Network focus here. Stay tuned to our Twitter and Discord for expansion announcements throughout the year.

3. Bringing Account Abstraction Wallet to Mainnet

Our close collaboration with Taiko marches forward in Q2 2024.

Taiko is set to launch its last A6+ testnet this month, which is meant to be the final test ground before mainnet launch.

We will be deploying our new Account Abstraction wallet on top of this testnet as well in preparation for launching on mainnet.

We will be working closely with Taiko to promote the Loopring Smart Wallet during this phase — keep an eye out for an upcoming announcement and big Galaxe campaign, with even more collaboration moving into mainnet!

4. Loopring Browser Extension Wallet

The first phase of the Loopring Browser Extension Wallet is nearing completion and expected to release sometime around the end of the first half of the year.

Version one of the new browser wallet will simply give new simple wallet functionality to the Loopring Wallet on the web. Later phases will be rolled out with more native functionality for DApps and other cool features.

This is another big step in the Loopring Wallet journey, allowing users to access the Loopring ecosystem in whatever the most convenient medium is for them.

5. Low Cost, Fast Withdrawals <> L2

In Q2, we’re going to be rolling out a new bridging option to Loopring L2 users that will cut down costs on deposits and withdrawals for popular coins (including ETH, LRC, USDC, USDT, IMX) by around 50% — it will also speed up the process to around a minute.

This will be a new trusted bridging option, offered to users as an alternative to the trustless Ethereum bridge, which can take 30–60 minutes and potentially incur very high costs if Ethereum L1 is congested.

Users will always be able to choose between the trusted (like Orbiter as well) and trustless solutions. We believe in optionality and giving users lots of tools to use in any scenario they choose.

6. Smart Agents + Bots

A big part of the Loopring Smart Wallet’s future is making the wallet full of truly SMART technology, differentiating it from any competitors. This way, when the wallet is deployed across many networks, it will have many features that set it apart, making it the go-to wallet across crypto.

To enable this, we are working on building out new smart trade agents.

The upcoming smart trade agent infrastructure will introduce a host of new functionalities to enhance the Loopring Smart Wallet experience. To start off, these auto trading bots (or trade agents) offer users who want to trade but lack coding or trading experience an opportunity to passively put their assets to work using various automated trading strategies.

First implementations of trade agent functionality coming:

As we roll out the smart trade agent infrastructure, we will continue to release new trading orders and strategies that users can impliment to trade on their behalf.

First order types will include limit orders, stop-limit orders, and OCO (one cancels the other) orders. More complex strategies, like grid trading will come later.

Strategies like grid trading automates a user’s buying and selling by placing different order types at preset prices within a certain price range. It is an effective strategy in markets where prices tend to fluctuate within a specific range, as it can automatically execute trades within this predefined grid.

This strategy is a good option for traders who want to take a systematic approach to trading and capitalize on market volatility.

The use-cases for these new smart trade agents will be limitless. Expect a lot more details about what this all means and what use cases are coming once this infrastructure is released later this year.

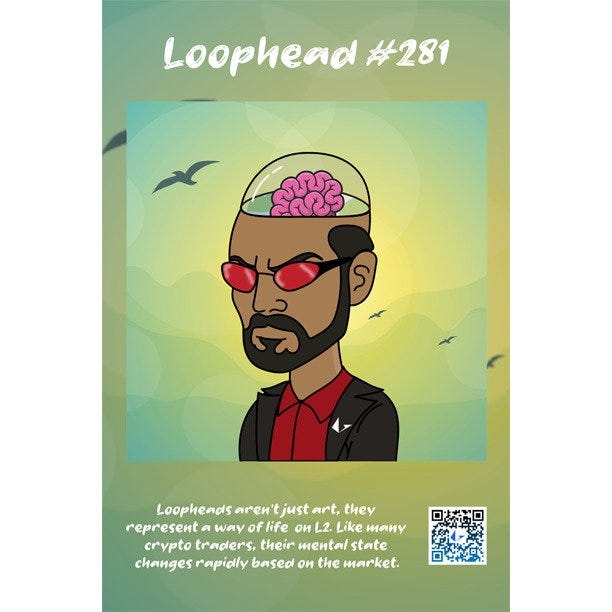

7. 2024 Loophead Challenge

We’ve been talking about it for a long time, but now the time has finally arrived. We will be officially launching the ’24 Challenge in April, in combination with an upcoming Galxe campaign with Taiko to promote the Taiko wallet within the Loopring app.

The year-long Loophead challenge is technically already underway (we will formally announce the rules to follow in an upcoming blog), where we will be doing new task challenges paired up with all of our new product launches throughout the year — rewarding Loopring users with some of the last remaining Loophead NFTs for trying out new products👇

✅Complete tasks

✅Bind your wallet (if required by the task)

✅Receive Loophead-filled Red Packets

You can already get qualified for these Red Packets by deploying a new Taiko A6 or A7 wallet (released shortly) and then binding it to a Loopring L2 account.

But Loophead NFTs won’t be the only thing given away during the challenge!

We will also be giving away some fresh, new Loophead Wearables throughout the year (as well as some other surprises).

At the end of the year, once all the tasks have finished, we’ll be hosting some grand finale giveaways across social media. Users who participated in tasks along the way will also be entered into these grand finale draws to win some big prizes such as LRC rewards, new specially designed Loopheads, more wearables, and some other prizes.

It’s going to be a fun grand finale so you’re going to want to participate throughout the year to get your hands on some of these prizes. In order to participate, you’ll need to download the Smart Wallet and get into our Discord or tuned to our Twitter for the most up-to-date announcements on the launch of each task.

⭐️ Community Section ⭐️

Community Ambassadors + Builders

We’ve made a lot of big changes to our Community Ambassadors + Builder initiative over the past couple years since its inception. Read up in our new updated blog to discover all of the new changes and how exactly anyone can get involved and become a Loopring Ambassador to earn a new role + Loophead NFT in the process.

To summarize, Community Ambassadors are now native to each different social media, to better acknowledge and incentivize members of the community on the platforms that they prefer to interact on and help grow the overall Loopring ecosystem there.

This is in addition to our Loopring Legends (builders) role, which will remain the sole Loopring team voted role, reserved for builders in the community who have contributed code, tools, and bigger projects to the Loopring ecosystem.

We now have 4 separate roles that can be earned, each one that comes with a shiny new Loophead NFT:

Loopring Legends — are talented builders in the community who are developing code, games, features, or tools directly for the Loopring ecosystem.

L2 Loopers — are stand-out community members who are helping encourage Loopring ecosystem adoption by regularly promoting Loopring or helping new users across Twitter/X.

Loopring OGs — are stand-out community members who are helping encourage Loopring ecosystem adoption by regularly promoting Loopring or helping new users across Discord.

Loop Troopers — are stand-out community members who are helping encourage Loopring ecosystem adoption by regularly promoting Loopring or helping new users across Reddit.

In order to qualify for one of these roles, you simply need to be active on one of these social platforms in helping to promote the Loopring ecosystem or helping to onboard new users to the ecosystem.

Users can nominate others for the role, and up to the Top 8 nominees each quarter will be placed into a final vote, native to each platform at the end of the month.

Based on the voting in each quarterly competition:

🥇 Top 1 in voting (on each social platform) — will win a new role in the ecosystem that comes along with a brand new Loophead NFT

🥈🥉 Top 2–3 in voting (on each social platform) — will become locked in for future quarterly competitions (assuming they remain active in the community) as well as win Loopring Wearable NFTs as consolation prizes for finishing in the Top 3

Below are the new additions who have been assigned new roles this past quarter ↓ ↓

New Loopring Legends🧡:

fenneckit

New L2 Loopers💙:

TurntManJimi

New Loopring OGs❤️:

sterlingpound

️⭐ Community News 👇

We have such an amazing and rapidly growing community with so much happening that we want to dedicate a section of our updates to sharing some more of the cool things going on in the community!

Note: Loopring does not directly endorse the use of any third-party applications that we have not been able to independently verify the code, so please exercise caution and use at your own risk.

✧️️️✦️️️✧

LayerLoot

Loopring L2’s newest NFT Marketplace is now live in beta!

Created by a legend in the community — fuzzy — this new NFT Marketplace already accepts both ETH + LRC as tokens for selling or buying your favourite NFTs on Loopring.

Check out the new web DApp here or access it directly from your Loopring Smart Wallet in the L2 utility section!

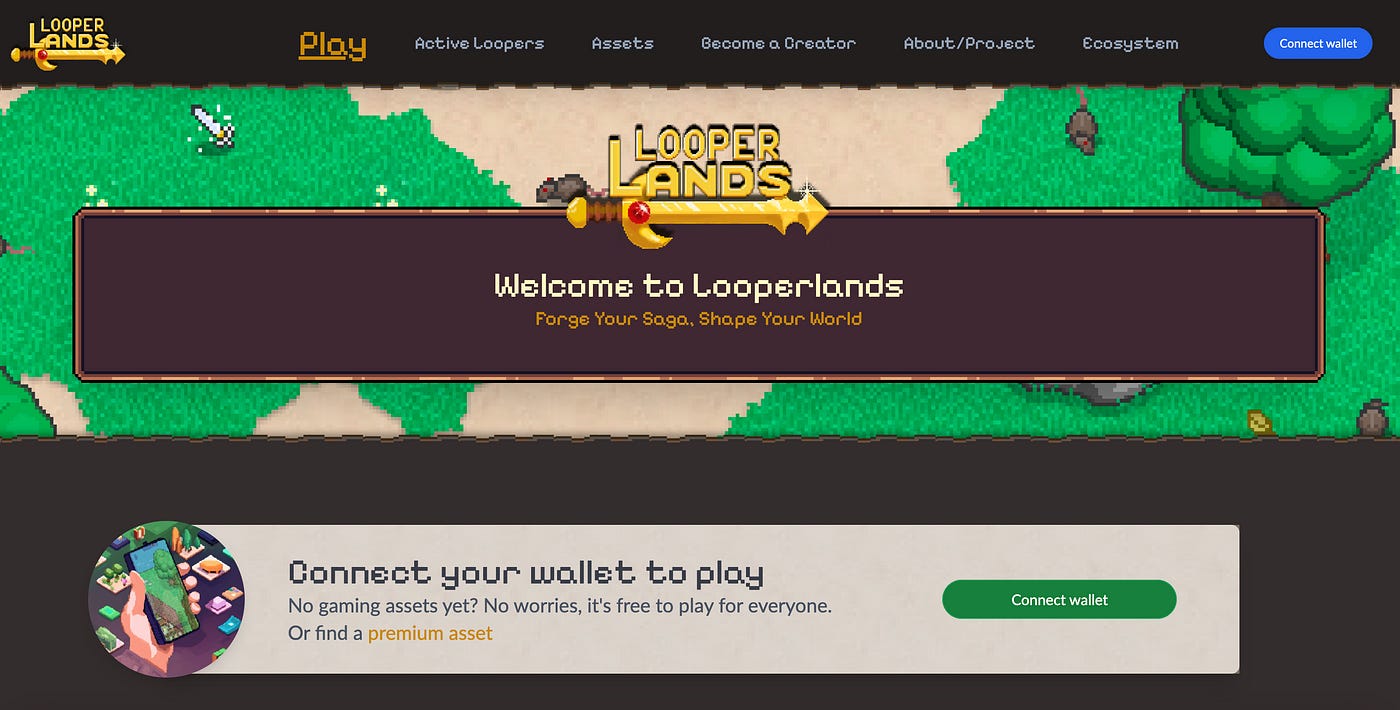

LooperLands

We are extremely excited and proud to be sharing the growth of one our OG builders on Loopring — LooperLands.

LooperLands has been busy over the past months as well:

🔸a whole new look with their updated home page

🔸expanded to Taiko

🔸free-to-play — no need to purchase an NFT character to start

Be sure to head on over to LooperLands website, connect a wallet and try it out if you haven’t already.

You can also play from directly inside your Loopring Smart Wallet by accessing the new DApp browser in the utility tab!

Want to get into the next Community section?

Check out our latest community initiative blog + get involved.

— or —

Get into our Discord server and post your community events into the #community-initiatives channel or make some noise on Twitter and we will follow along and pick out some of the coolest things happening on Loopring L2 and post them in each new addition of our quarterly reports.

Questions & Feedback

If you’d like to talk to us about any partnerships, have questions, and/or feedback, please join our Discord, or drop us a line at: foundation at loopring dot org. We also have an active Reddit community for anyone to join and contribute to the ecosystem.

Love your Loopring Experience?

Consider rating us in your preferred app store. It helps Loopring become more easily discovered by other potential users!

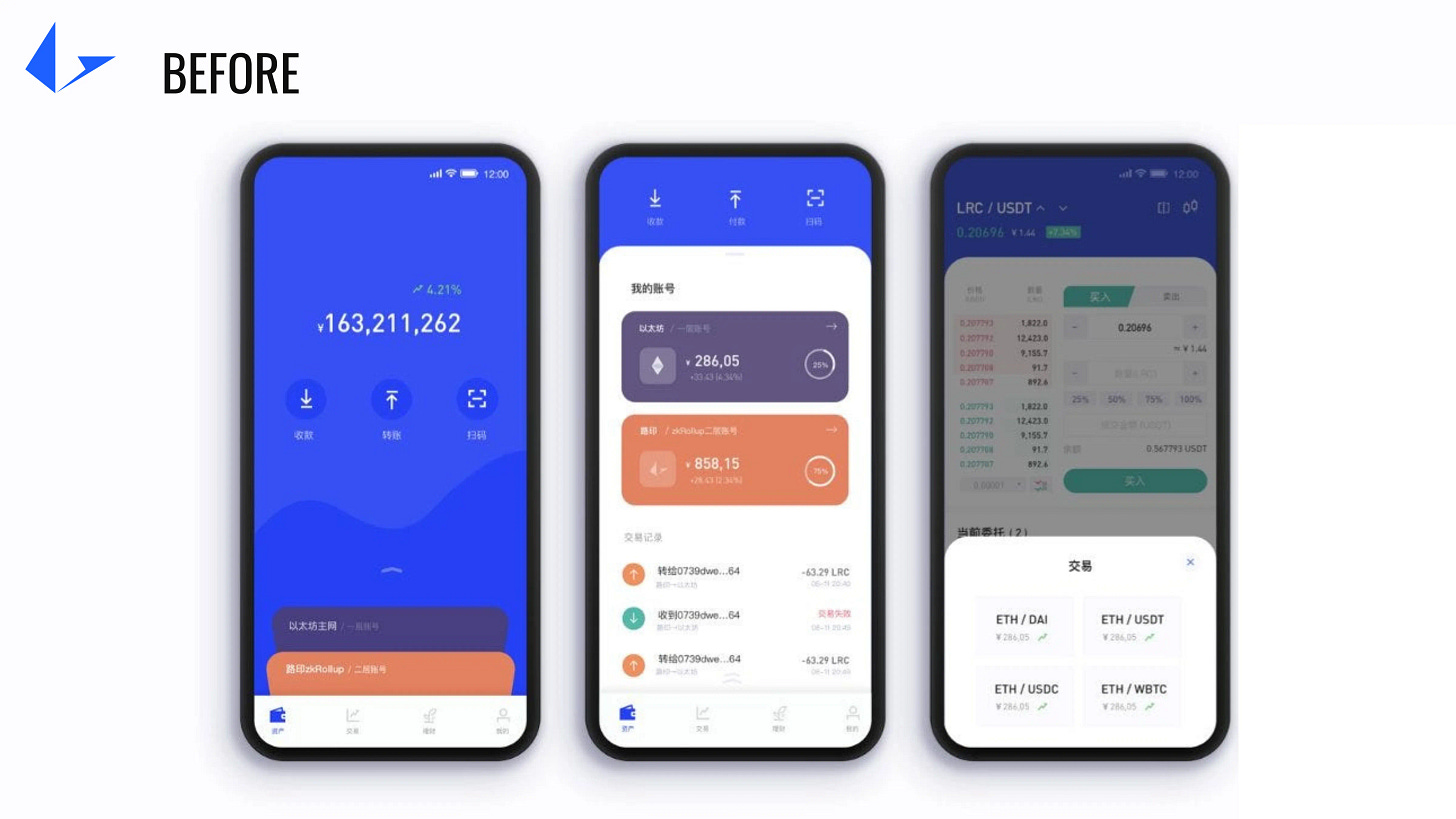

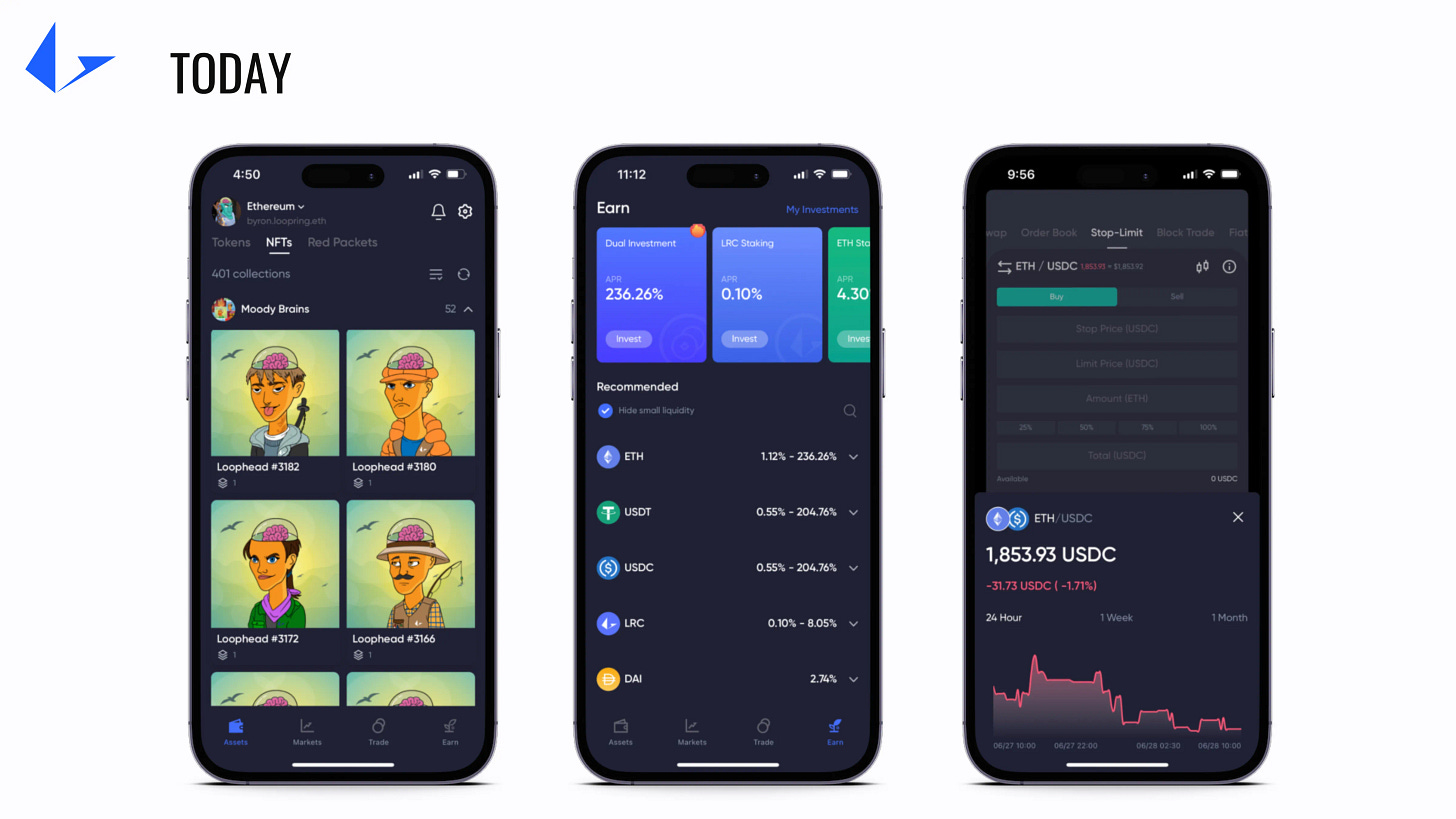

About Loopring

Loopring is an Ethereum Layer 2 zkRollup protocol for scalable, secure DeFi and NFT applications. Loopring builds non-custodial, high-performance products atop our L2, including the Loopring Wallet — a mobile Ethereum Smart Wallet, and the Loopring L2 web app — an entire L2 ecosystem, including orderbook and AMM DEX, NFTs and Loopring Earn products. To learn more, follow us on Medium or see Loopring.org.

Twitter ⭑ Discord ⭑ Reddit ⭑ GitHub ⭑ Docs ⭑ YouTube ⭑ Instagram